Nevada

Starting a Nonprofit in Nevada

Nevada is a thriving hub for community based organizations. Our step by step course will help you navigate state and federal filing with confidence.

In Nevada, nonprofits file Articles of Incorporation with the Secretary of State Commercial Recordings Division and pay a $75 filing fee. Nevada requires at least three directors. Charitable organizations must register with the Nevada Secretary of State Charitable Solicitations Division if they plan to raise funds. Annual list filings and business license renewals are required.

Inside the Course You’ll Learn How to:

• Draft and file your state’s Articles of Incorporation correctly

• Apply for your IRS EIN and 501(c)(3) tax exemption

• Build a legally compliant board structure

• Complete your charitable registration

• Develop bylaws, policies, and launch strategies tailored to your mission

Amillion Treasures

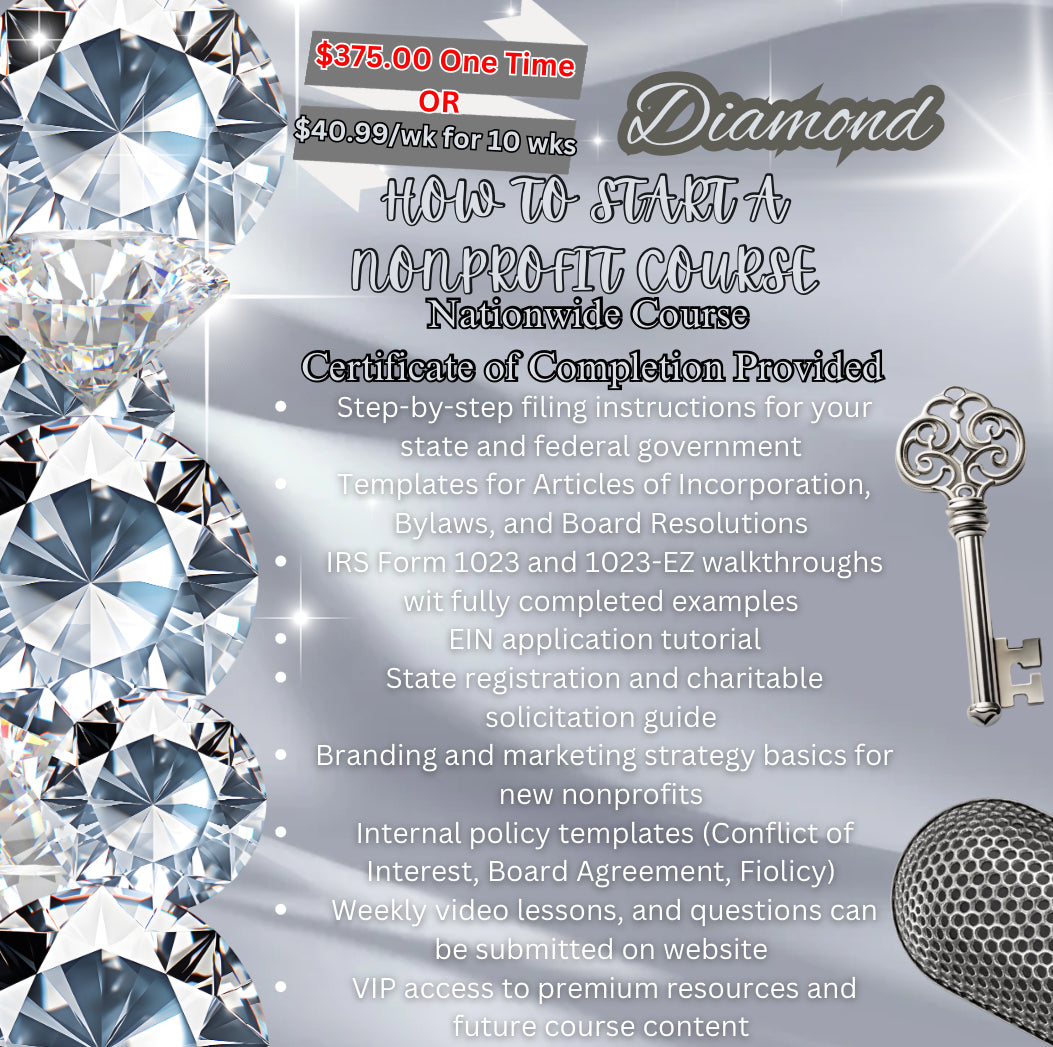

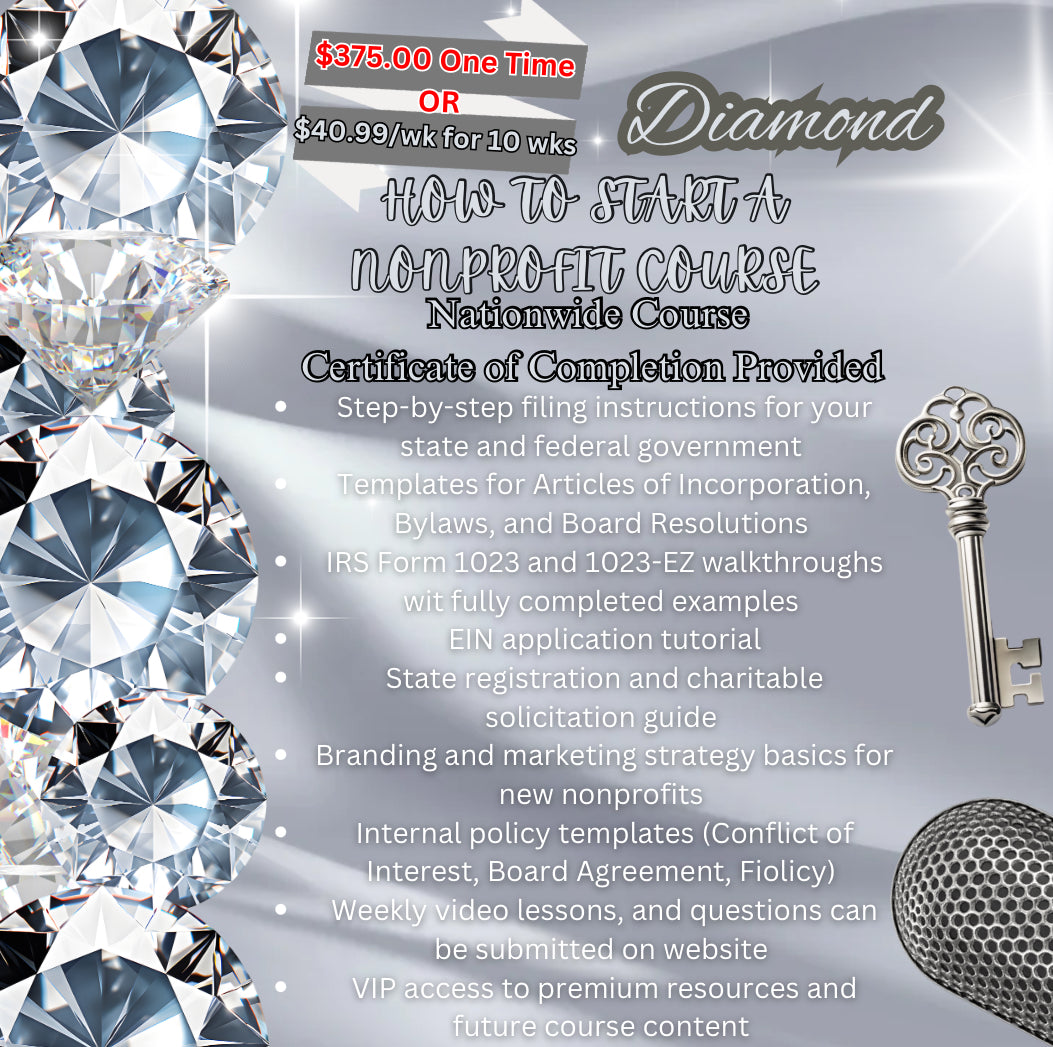

How to Start a Nonprofit 501(c)3 ~ DIAMOND

Share